Introduction

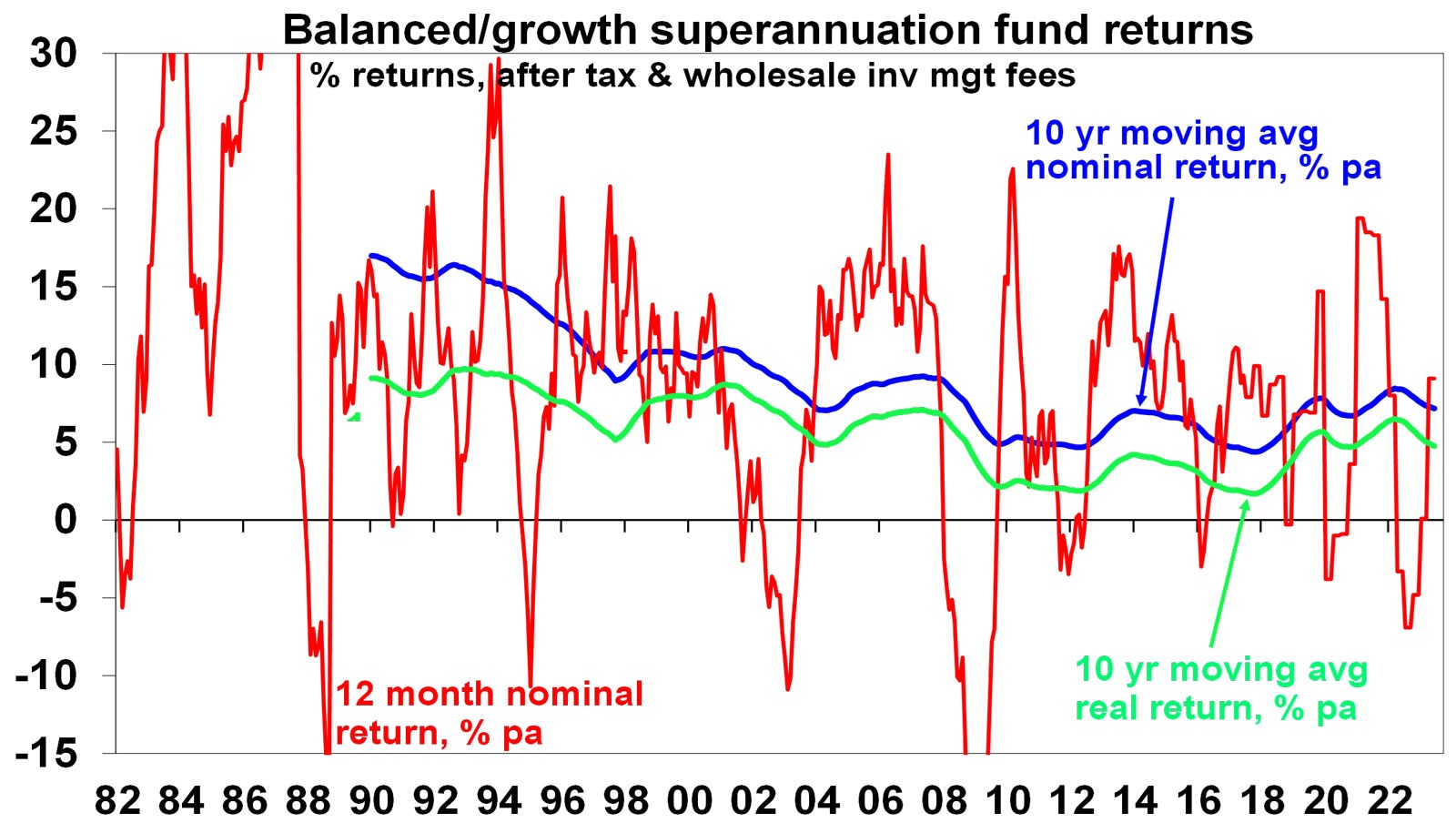

Starting in the early 1980s investment returns were spectacularly strong. Sure there were bumps along the way like the 1987 share crash, but Australian balanced growth superannuation funds returned an average 14.1% pa in nominal terms and 9.4% pa in real terms (i.e. after inflation) between 1982 and 1999. And that was after taxes and fees. This was well above what would normally be expected from such funds.

Source: Mercer Investment Consulting, Morningstar, AMP

Since 2000, nominal super returns have been more constrained averaging 6.2% pa as we entered a lower return world with real returns averaging 3.6% pa. Mind you, this is still pretty good considering that 1 year bank term deposit rates averaged just 3.7% pa and only 1.1% pa after inflation, and that was before taxes. The odds are that returns are likely to be even more constrained over the next 5 to 10 years.

What drove the strong returns from the early 1980s?

There was an element of mean reversion (or payback) after the poor returns of the high inflation 1970s. But fundamental drivers were:

- Economic rationalist policies – deregulation, privatisation, competition reforms, tax reform and free trade – as policy makers focussed on supply side reforms in reaction to the inflation of the 1970s.

- Globalisation which boosted trade and competition and lowered costs.

- Easing geopolitical tensions with the ending of the Cold War in 1989 which led to the peace dividend of reduced defence spending.

- Corporate focus on return on capital.

- Positive demographics as baby boomers entered peak consumption and peak productivity.

- Inflation targeting by independent central banks with a focus on keeping inflation and inflation expectations at low levels.

- And, of course, the tech boom of the 1990s.

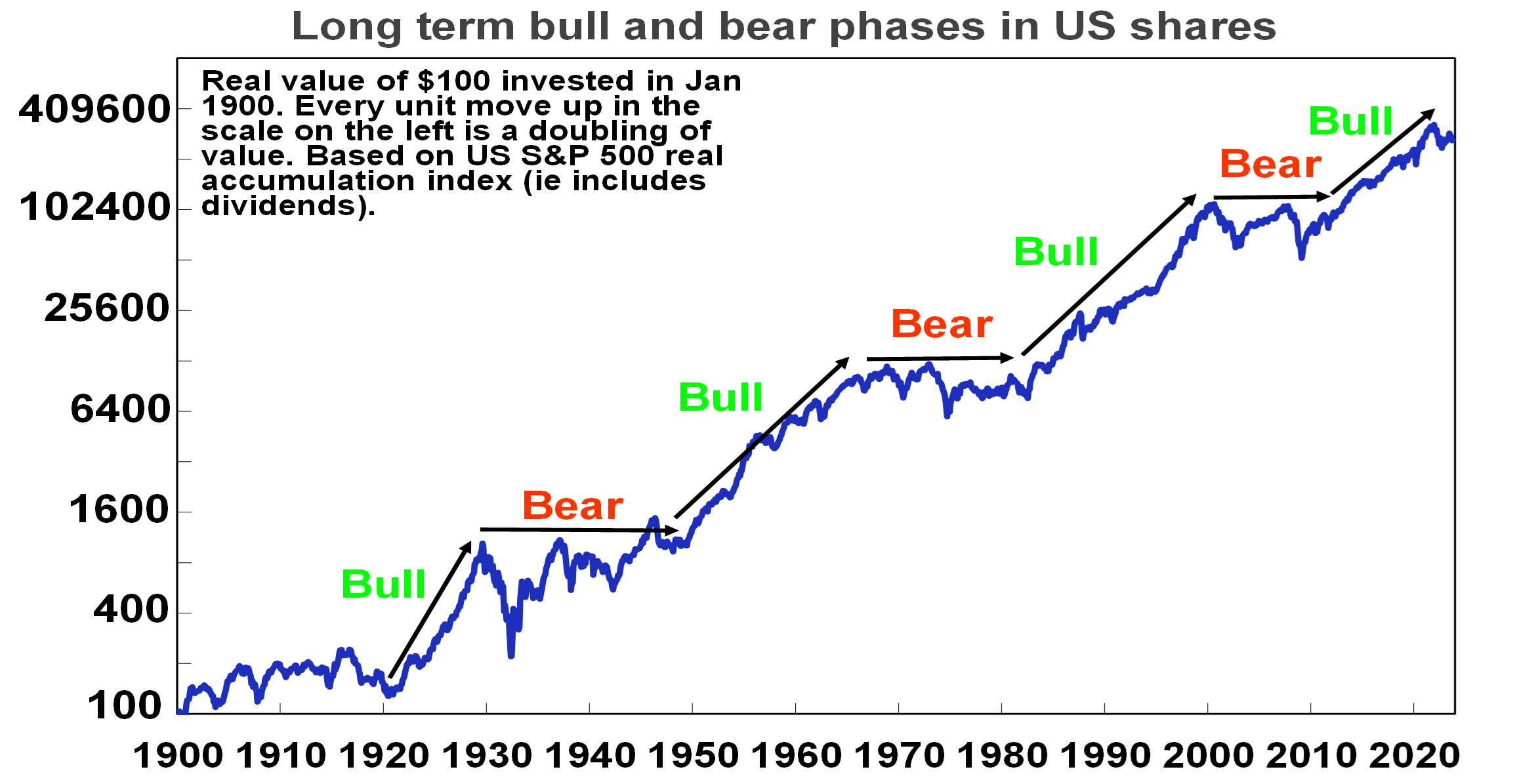

Taken together, this drove low inflation and strong productivity growth which underpinned a secular bull market in shares – which are the biggest exposure in balanced growth super funds – through the 1980s and 1990s. See the next chart. It paused in the US in 2000-2013 but then took off in Australia with the 2000s resources boom only to take off in the US again from 2013 helped by ever lower interest rates into the pandemic (which pushed up the value of shares and other growth assets). Meanwhile bond returns were high given their high starting point yields in the early 1980s.

Since 1900 there have been four major secular bull markets in US shares: the 1920s (with electricity; chemicals & mass production); the 1950s and 60s (with petro chemicals, electronics & aviation); the 1980s and 90s (see the text); and since 2013. Source: Bloomberg, R Shiller, AMP

Megatrends – five key constraints on returns

Unfortunately, the drivers of strong returns from the 1980s are reversing. There are five megatrends of relevance.

- Bigger government, less economic rationalist policies

As a result of the problems highlighted by the GFC, rising inequality, stagnant real wages, aging populations, climate change, the success of government income support in the pandemic, the rise of populism and a collective memory loss regarding the lessons of the past there is a backlash against economic rationalist policies and more support for big government. It’s evident in Australia, with the rising share government spending, widespread support for higher taxes and labour market reregulation. The risk is lower productivity and higher inflationary pressure.

- The reversal of globalisation

The post-WW2 period saw a huge surge in global trade and financial links between countries as more countries entered the global trading system and trade barriers collapsed. This saw production allocated globally according to comparative advantage and highly integrated global supply chains. The cost reductions and competition helped reduce inflation. But the trend towards freer trade stalled in the 2000s and trade barriers are on the rise. The pandemic, rising geopolitical tensions and rising nationalism are accelerating this. Support for free trade policies has faded in favour of friendshoring, onshoring and old-fashioned protectionism to support manufacturing locally, e.g. with subsidies for battery projects and electric vehicles. Inevitably this will lead to higher costs.

- Increasing geopolitical tensions – a new cold war

Declining military spending into the 2000s was disinflationary. This was facilitated by the move to a “unipolar” world dominated by the US and increasing believe in free market liberalism. This started to fracture after the GFC and we are now in a “multipolar” less stable world with arguably a new Cold War between China, Russia and Iran on the one hand and Western countries on the other. The war in Ukraine and now Israel are arguably signs of this. This adds to the threat to free trade but also risks increased military spending. This means more demand for metals and more government spending which will add to inflationary pressure.

- Climate change and decarbonisation

Ultimately the shift to sustainable energy could result in lower costs. But we are a long way from that and climate change and the move to net zero will add to costs and inflation via: extreme weather events; associated rebuilding and higher insurance premiums; costs of mitigation; increased metals demand as economies retool; and increased pollution regulation.

- Less workers, more consumers

Global population growth is slowing, while in advanced countries and China the working age population is declining. And populations are aging, resulting in a rise in the ratio of children and older people to working aged people. Thanks to its high immigration program Australia is in a somewhat better position. But globally, the upshot is less workers (supply) and more consumers (demand) which will add to inflationary pressures.

Implications for growth and inflation

Taken together, these key megatrends risk lowering productivity growth making economies more inflation prone. There is some offset with technological innovation – with artificial intelligence offering significant potential to boost services sector productivity, although this will take time to materialise. But the more inflation prone environment means central banks will have to work harder to keep inflation down, which will require higher and more variable interest rates than we saw pre-pandemic.

The collapse in inflation from the 1980s provided a tailwind for super returns because the fall in interest rates and economic uncertainty allowed growth assets to trade on lower investment yields and higher price to earnings multiples (which boosted capital growth). A more inflation prone world will remove this tailwind and threaten its reversal with cash and fixed interest becoming relatively more attractive, price to earnings ratios on shares settling at lower levels and income yields on real assets at higher levels (which will constrain capital growth).

What does all this mean for medium term returns?

Our approach to get a handle on medium-term (i.e. 5-10 year) return potential of major asset classes is as follows:

- For bonds, the best predictor of future medium-term returns is current yields. The rise in yields has increased their return potential.

- For equities, current dividend yields plus trend nominal GDP growth does a good job of predicting medium-term returns.

- For property, we use current rental yields and likely trend inflation as a proxy for income and capital growth. The surge in online spending and “work from home” means significant downside risks to returns.

- In the case of cash, we use our forecast cash rate over medium term.

Our latest return projections are shown in the next table. The second column shows each asset’s current income yield, the third shows their 5-10 year growth potential, and the final column shows their total return potential. Note that: we assume inflation averages around 2.5% pa; and we have cautious real economic growth assumptions reflecting the five megatrends noted above. This will likely constrain capital growth.

Producted medium term returns, % pa

| Current Yield # | + Growth | = Return | |

| World equities | 1.9^ | 4.7 | 6.6 |

| Emerging equities | 2.2^ | 7.3 | 9.4 |

| Australian equities | 4.3 (5.6*) | 3.7 | 8.0 (9.3*) |

| Unlisted commercial property | 4.6 | 2.5 | 7.1 |

| Australian REITS | 5.0 | 2.5 | 7.5 |

| Global REITS | 4.0^ | 2.5 | 6.4 |

| Unlisted infrastructure | 3.9*^ | 3.0 | 6.9 |

| Australian bonds (fixed interest) | 4.5 | 0.0 | 4.5 |

| Australian cash | 3.0 | 0.0 | 3.0 |

| Diversified Growth mix | 6.7 | ||

| Diversified Grth mix* ex fees & tax | 5.5 |

All returns are pre fees & taxes except the final row. # Current dividend yield for shares, net rental yields for property & duration matched bond yield for bonds. ^ Includes forward points. * With franking credits added in. Source: AMP

Key observations

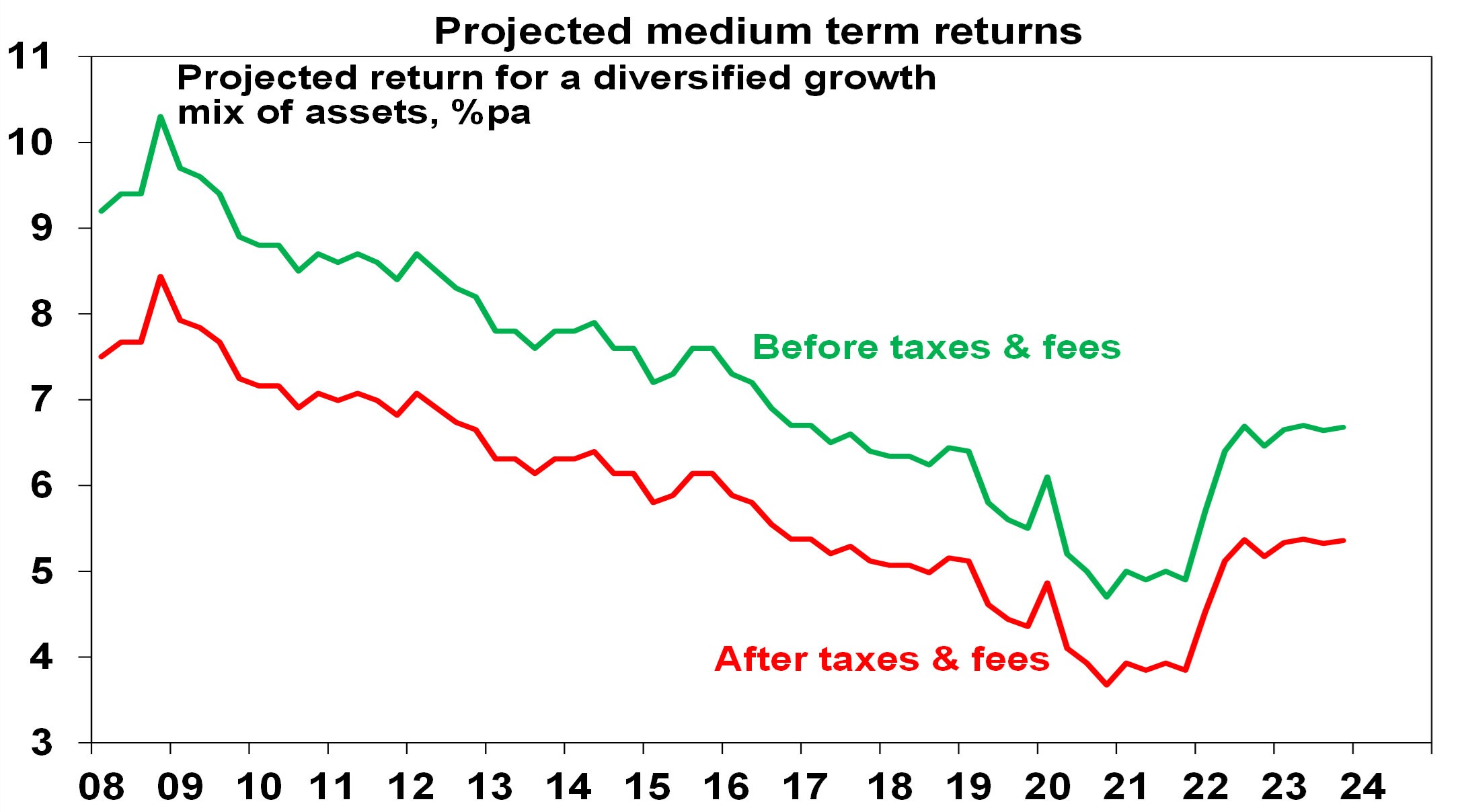

- After falling for many years due to the fall in starting point yields for major assets the medium-term return potential using this approach has improved to around 6.7% over the last 15 months (see next chart) due to now higher starting point interest rates and bond yields and somewhat higher starting point yields on shares (which remain down in value from record highs) and commercial property.

- After allowing for taxes and fees this still implies pretty constrained nominal medium term returns for balanced growth super funds based on a traditional mix of assets of 5.5% pa which is a bit below the average since 2000. This is still better than bank term deposit rates which average up to 4.5% before taxes and makes no allowance for any value added from active investment management.

Source: AMP

- The main downside risk is that inflation trends higher, driving a further trend rise in interest rates, bond yields and yields on shares, property and infrastructure, resulting in an ongoing drag on capital growth.

Implications for investors

- First, have reasonable return expectations. In the past super returns were boosted by very favourable conditions which have now faded.

- Second, remember there is no free lunch – investment opportunities offering higher returns likely entail much higher risk.

- Third, medium term returns from super are still likely to be well above bank term deposit rates on an after tax and fees basis.

- Finally, while bear markets are painful, they push up the medium-term return potential of shares and so provide opportunities.

Source: AMP