Majority of working Aussies to benefit from personal income tax cuts

Tax cuts proposed in the recent Federal Budget were passed in parliament on Friday 9 October, and you might see some of the benefits before Christmas.

The government has brought forward tax cuts originally planned for 1 July 2022 and backdated them to 1 July 2020. Plus, low and middle-income earners are still able to benefit from existing tax offsets.

Has my marginal tax rate changed?

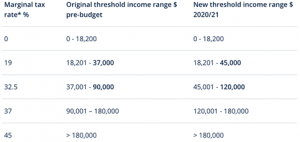

The upper thresholds have increased for some tax brackets, as highlighted in the table below.

(*excluding 2 % Medicare Levy)

Can I benefit from the tax offsets?

If you earn up to $126,000 per year, you may be eligible for the low and middle income tax offset (LMITO). This was previously introduced as a temporary measure and scheduled to end when the 1 July 2022 tax cuts kicked off. But the good news is that despite bringing forward these tax cuts, the government has kept the LMITO for the 2020–21 financial year.

And, if you earn less than $66,667 per year, you may be eligible for an additional tax offset called the low income tax offset (LITO). As part of this package of tax cuts, this tax offset was increased from $450 to $700.

How much will I save from the tax cuts?

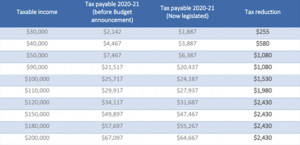

The below table shows indicative tax cuts, based on the legislative changes for an individual in 2020-21, to the tax rates, thresholds, and offsets that were applicable for 2020-21 (before these changes):

When will I receive the new tax savings?

Your take-home pay should reflect the new rates before Christmas. The Australian Taxation Office (ATO) has given employers until 16 November to make changes to payroll processes and systems.

As you’ll have already paid personal income tax at the original rate since 1 July this year, you’ll receive your entitlement to the reduced tax payable for the entire 2020–21 income year when you lodge your income tax return.

Source: AMP