Looking for higher returns than cash in the bank with less volatility than shares and property? With interest rates generally considered to be at or near their peak, fixed interest investments, such as bonds and other credit investments, may offer an attractive ‘middle ground’.

Interest rates represent the cost of borrowing money. They affect how much you earn from your savings and how much you pay for your debts.

When interest rates are high, you can earn more income from your savings but it costs more to service your debt. Conversely, when interest rates are low, the cost of servicing debt is lower but so is the income you can earn from your savings.

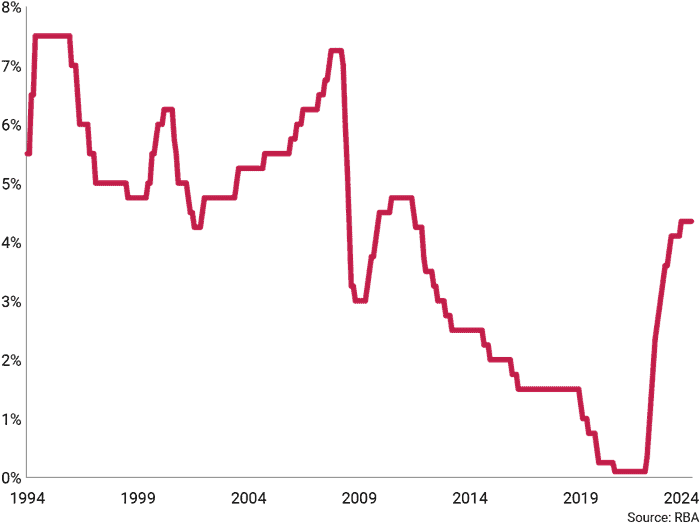

Interest rates in Australia followed a generally downward path following the Global Financial Crisis in 2008, reaching historic ultra low levels of 0.10% during the COVID-19 pandemic.

However, since 2022, Australians have witnessed the most rapid increase in official cash rates of the past 20 years.

Australian cash rate target

Interest rates likely to stay higher for longer

With inflation in Australia remaining persistently high and ‘sticky’ in recent times, the Reserve Bank of Australia (RBA) is expected to keep interest rates fairly high in the near future.

For investors holding high levels of cash this has been welcome news, as these savings are now generating higher levels of interest income. Although this is being eroded to some extent by headline inflation that has remained generally above 4% since it peaked at more than 8% in December 2022.

The potential for higher returns while protecting capital

For those investors looking for less volatility and risk, traditional fixed interest (otherwise known as bonds) and other credit investments can offer an attractive ‘middle ground’ of higher returns than cash with lower volatility than shares, and consistent income. Examples of this include investments in government or company issued debt securities (or bonds), and emerging opportunities in private credit.

Bond prices move inversely to interest rates, meaning that when interest rates rise, bond prices fall, and vice versa. While this dynamic can cause losses during a rising interest rate environment (as was the case in 2022 and 2023), it is a widely accepted view that the current interest rate cycle in Australia is close to a peak.

Fixed interest securities (bonds) now offer the advantage of a higher yield, and the potential to protect investor capital if interest rates decline due to a softening economy.

In contrast, many other credit investments are at a floating rate – meaning their returns follow interest rates, although they may also provide a better return or yield than cash investments.

New opportunities in credit markets

The current economic and interest rate environment offers some very interesting opportunities in fixed interest and credit markets, both globally and in Australia, and across publicly traded and private markets.

Private credit, or capital lent to companies by non traditional lenders such as private investment funds, may offer investors attractive, risk adjusted returns.

These types of investments are higher risk than cash and in some cases less able to be converted to cash quickly, but they may also offer higher interest payments than their cash equivalents.

Do your homework

The current interest rate environment has revealed and in some cases created some compelling fixed interest and credit opportunities

However, it is always critical to do your own homework on underlying investments and their creditworthiness, and asset backing and diversification remain important.

Higher returns usually come with higher risk, so consider consulting a financial adviser to find a balance that suits your individual needs and preferences.

Source: Colonial First State